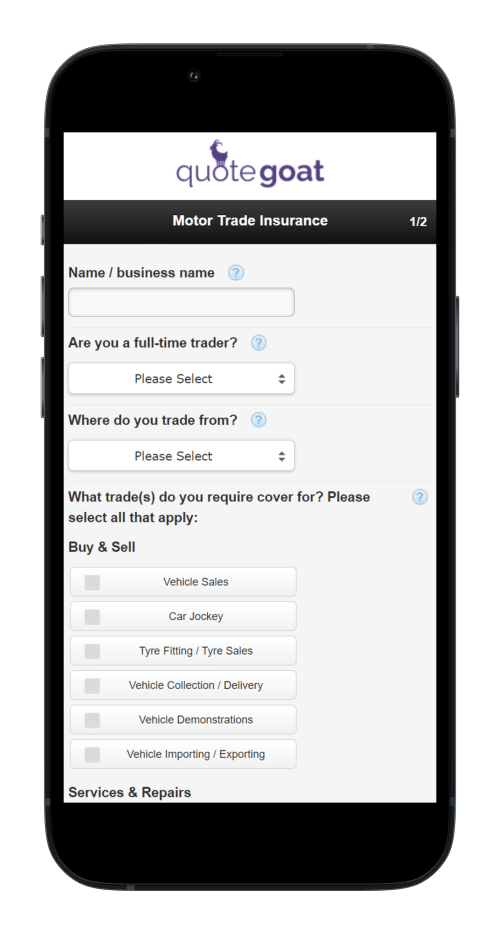

Motor Traders Insurance Comparison

Compare prices for all types of motor trades, from vehicle sales insurance and breakdown recovery, to MOT station insurance, servicing and valeters insurance. We work with a panel of leading UK insurance providers who will provide tailored quotes and specialist assistance whilst competing for your business.

It takes less than 30 seconds to complete the quote form. After submitting your details, you will be contacted by our panel of traders insurance providers.

Get a quote through Quote Goat to find the right cover at the right price.

Protect Your Business With Motor Trade Cover

In the motor trade industry, finding a policy that protects the right elements of your business at the right price can be time consuming and confusing. To save time and money, we make it easy to arrange quotes for tailored cover along with expert guidance and advice.

Cover yourself and your business against risk with a quote for your motor trade insurance policy that can include a range of covers including premises, road risk, asset cover, and public liability. Whether your business is in motor vehicles, sales, demos, MOTs and testing, servicing, tyre fitting or sales, breakdown recovery or another other specialism, we’re confident we’ll be able to provide you with a quote you’ll be pleased with.

What is Motor Trade Insurance?

Designed for any type of business operating in the industry, motor trade insurance often covers a great deal more than general car insurance as we look at in the section below. There are also a wide range of options to choose from, so it’s important to know exactly what your business requirements are by law. If you are unsure, you can get advice from an insurance broker during your quote.

There are plenty of optional extras and varying levels of cover motor traders can specify on their motor trade insurance policy, including risks, liability and premises insurance. Thankfully, one policy can cover all vehicles the trader drives or supervises.

What Does Motor Traders Insurance Cover?

Unlike more general car insurance policies, motor trade cover is tailor made to suit individual companies. Therefore it is important to assess what kinds of risks your company will need cover for; mechanics and car valeting companies will both need motor traders insurance but both will require different cover. When you get a quote you will be able to seek advice from motor trade insurance specialists who can guide you through arranging the right insurance policy for your particular requirements.

Some of the most common covers included in a policy are:

Road risk insurance – for businesses that are required to drive their customer’s vehicles on public roads; whether they are delivering vehicles that have been sold or leased or are required to take vehicles for a test drive when they are under repair. Road risk is typically considered the minimum level of insurance that a motor traders will require and is often used by motor trade businesses operating from home or small operations.

Combined motor trade insurance – This policy combines road risk and material damage cover as well as a range of optional covers to ensure that if you are required to work on vehicles off the road and drive them on public roads you are covered for any eventuality. Often cheaper than taking out separate policies.

Public Liability Insurance – this covers you and your employees from any claims made by a member of the public, including your customers.

Material Damage Cover – insures all of your vehicles and equipment, even when not in use.

Employers liability insurance – a form of cover which protects the company in the event of a claim from one of its employees.

Vehicle types – if your employees drive a number of different vehicle types they will need specialised cover to protect them. This policy can be applied to all employees at a higher cost or limited to a select few employees in order to save money.

Do I Need Motor Trade Insurance?

We have already mentioned a number of companies that require motor traders insurance, including mechanics and car valet services, however the policy is a legal requirement for any business where their own vehicles or customer vehicles fall under the ‘care, custody or control’ of any of their staff. If you are new to the industry, visit our guide for people looking to purchase motor trade insurance for the first time.

Keeping The Cost Of Traders Insurance Down

As with all insurance products, the price you pay will depend on the level of insurable risk you present, for example multi car motor trade insurance is likely to cost more than a policy to that covers one company vehicle. To keep the cost of your policy to a minimum you should bear the following in mind:

No claims bonus

Similar to a standard car insurance policy, you are able to build up a no claims bonus for on your trade policy also. You can usually expect to see a reduction in your policy for each additional year of no claims bonus that is accrued. Keep in mind that your personal car insurance no claims bonus is also taken into account, maintaining both no claims bonuses is a great way to keep your motor policy costs to a minimum.

Compare annually

Although it is simpler to renew your policy each year with the same insurance provider, comparing quotes prior to renewal helps to ensure you are always paying a fair price for your insurance. It is well known that loyalty is often not rewarded in the insurance industry.

Experience

Driving experience and age are factors that play a part in the cost of an insurance policy. Motor trade insurance for drivers under 25 is typically harder to find as well as being more expensive. Although in reality you are unlikely to adjust your hiring methods dependent on this factor, it is worth bearing in mind when it comes to deciding which employees you should add to your motor trade policy. As well as age, drivers who have convictions and/or previous claims on their insurance are likely to drive up the price of your policy.