Compare Business Funding Quotes Now

1

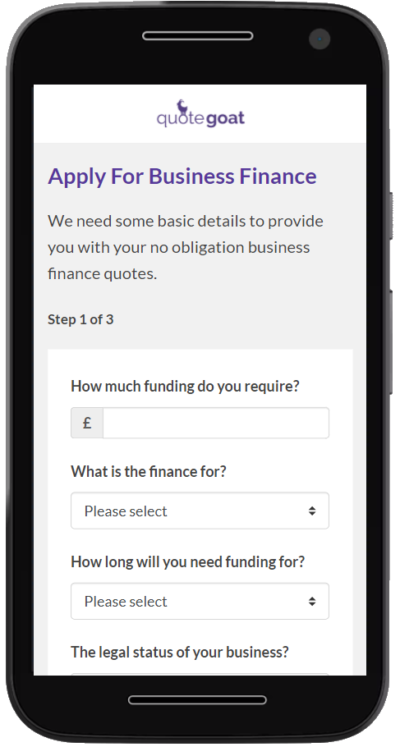

Apply For Business Funding

To start your search for business funding, simply complete the online questionnaire about you, your business and your funding needs. It’s absolutely free to use and only take a few minutes.

2

Speak To The Experts

Your business is matched to suitable providers on the panel who may be able to fund you. This won’t impact your business credit rating. Discuss your requirements with a dedicated business financing expert.

3

Decide In Your Own Time

There’s absolutely no obligation and no pressure. Decide when you’re ready.

What types Of Business Financing Are Available?

Unsecured Business Loans

Unsecured Business Loans

Flexible, alternative finance solutions without offering security.

Secured Business Loans

Secured Business Loans

Lending that uses assets as security. Click here for more information on secured business loans.

Merchant Cash Advances

Merchant Cash Advances

Borrowing based on future card sales with flexible repayments. Find out more about Merchant Cash Advances

Asset Finance

Asset Finance

Funding for machinery, vehicle and equipment purchases. Spread the cost of assets over a period of time – compare asset finance quotes.

Invoice Finance

Invoice Finance

Flexible, alternative finance solutions without offering security. Find out more information about Invoice Finance

Short Term Business Loans

Short Term Business Loans

Access to finance required to plug short term cashflow issues.

Commercial Property Finance

Commercial Property Finance

Get the right property finance for your business.

VAT & Tax Finance

VAT & Tax Finance

Funding to help cover the cost of VAT or Tax payments.

Construction Finance

Construction Finance

Specialist funding against invoices or outstanding bills.

Will Your Business Qualify?

If you have been in business for more than 6 months and you a UK resident over 18, you could qualify for an unsecured business loan. All credit histories are welcome, so even if you have bad credit you could still be accepted for funding.

The initial application process takes no time at all and requires no paperwork.

How does it work?

Enter your details into the quote system and you will be matched with suitable lenders who may be able to fund your business. Getting a quote does is 100% free with no commitment and does not perform a credit check.

How long does it take?

You can receive funding in as little as 24 hours. The biggest factor is how quickly you can provide the necessary documents when requested. Typically you can expect it to take a few days to receive funding.

How much can I borrow?

There are a variety of funding types available through the quote form. The best way to see how much you could borrow is to get a no-obligation quote.

Are applicants with poor credit accepted?

Unlike traditional funding methods, poor credit is not necessarily a barrier to accessing funding when your business needs it.

What happens next after I apply?

Once you apply you will be contacted suitable lenders who can talk you through the various funding options available and progress with your funding application if you so wish.