Why should I compare young driver insurance quotes?

It can be hard to find affordable cover as a young driver, but car insurance companies have their reasons. Data shows that young drivers are the riskiest road users, making those new to the roads more likely to be involved in an accident, leading to increased car insurance premiums.

Research carried out by AA showed that by the age of 23, 40% of young British drivers have been in a road crash. Another survey from the RAC Foundation showed that young drivers in the UK were involved in 20% of all recorded collisions yet hold just 7% of all licenses.

Don’t feel singled out, though, as a young driver. It’s not just young drivers that are penalised for their lack of time behind the wheel. New drivers of any age are also paying sky-high car insurance bills.

Your car is a significant factor, too. If you’re commuting to work in a sports car, you’ll add £100s to your premium.

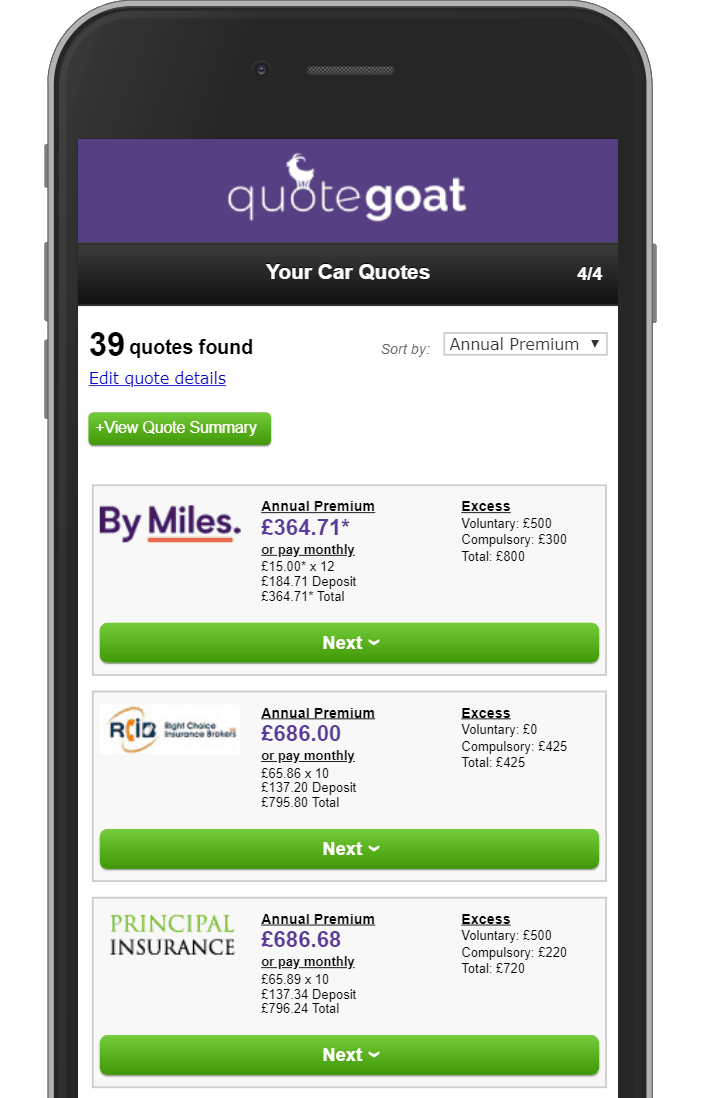

By comparing quotes from multiple insurance providers, you massively increase your chances of finding cheaper cover.

Insurance-related points to consider when buying your first car

The value of the car

The value of the car

This one speaks for itself. The higher the cost of the car, the more it would cost to replace if it was stolen or involved in a severe accident. Thus, a higher price on your premium.

Repair costs

Repair costs

You may only be involved in a minor prang, but if repair costs for your particular make or model of car are high – you’ll end up with a premium to match it.

The car’s security

The car’s security

Insurers are looking for key, built in security features which will hinder your car from being stolen. We’re talking alarms, immobilisers, or high-security locks fitted by the manufacturer.

Performance

Performance

High-performance stats may rack you up some impressive bragging rights, but you’ll also be forking out some serious money in insurance bills. Statistically speaking, fast cars and young drivers are more likely to be involved in accidents. Young drivers should ditch the 0-60 stats and go for a steady and reliable model to get favourable deals on their insurance.

The price of the parts

The price of the parts

Insurers look at the replacement cost of the 23 most common parts when considering premium prices. To save money, young drivers should keep things basic, mainstream and economical for the best deals. There’ll be time enough to opt for that classic car you’ve always dreamed of owning.

Companies that specifically offer young driver insurance

As a new driver looking to keep costs down, the marketplace can be a baffling mix of big brands, high prices and complex terms. So it pays to compare quotes.

Some companies tailor their car insurance packages for young drivers. Now, this can be hit and miss. They are not always the cheapest, but it’s worth looking around if you’ve got the time.

Find cheaper young driver car insurance costs with these simple tips

- Plan Ahead

Just passed your test? Congrats! But before you rush out and buy your first car, it’s worth putting in some solid research time. Checking out which cars cost less to insure can save you hundreds on your annual insurance premium. As a starting guide, the Toyota Yaris, Kia Rio, and the Renault Twingo were some of the cheapest cars to insure for young drivers in 2017. Another way to get a good deal on young driver’s insurance is to get an early quote. Whether planning for a renewal deal or buying a new car, getting a quote up to 30 days in advance means you can lock in a lower price before any price hikes. - Keep it locked

It may seem obvious, but keeping your car in a safe place is one of the simplest ways to keep insurance costs down. Any additional security measures you can take, such as parking your car on a driveway or locking your car away in a garage, will lower premiums. - Steer clear of modifications

Tempting as it may be to have the jazziest car in the neighbourhood, insurance companies won’t be impressed by your modifications. Any add-ons are going to ramp up your premiums further. The only exception to this rule? Any additional security measures you take can help. So pass up the large spoilers and invest in a good steering wheel lock instead. Your bank balance will thank you! - Shell out and save

If you can, paying for your insurance up front can bag you a better deal on your premium. Monthly direct debits spread the cost through the year and make things more manageable, but you’re essentially taking a loan, so you will have to pay more – often up to 10% more. So if you’re counting the pounds, this is an easy way to shave a sizeable sum from the cost. If your parents can loan you the money upfront, set up a direct debit and pay them back month by month, so you’re getting the lower price, spread evenly throughout the year. Best of both worlds! - Be smart on your policy

Let’s be clear. Lying to any insurance company is a big no-no. Anything other than the truth will invalidate your policy and could even see you become the subject of criminal prosecution. With all that said, you can still use some details to your advantage – so long as the details are still accurate. Job titles are a prime example. A simple change from a title such as Office Administrator to Customer Advisor can save you money. If you’re using price comparison sites or online companies, try different versions of your job title to see which gets the best results. You’ll be surprised at how much this simple trick can save you. - Improve your driving skills

A practical step could include taking an advanced driving course. Be sure to check with insurers before forking out for one of these courses. Not all insurers will lower the premium – even if you’ve passed the course with flying colours. Pass Plus used to be a popular option, but fewer companies are now offering lower premiums in return. Look for courses such as the Advanced Driver Course by IAM RoadSmart instead. Coming in at around £150, this is a great next step for newly qualified drivers. - Add another driver

Adding an older and more experienced driver to your policy can make a huge difference to car insurance costs for young drivers. There are rules to follow, though. Make sure you’re still the main driver and add someone who will drive the car. Better still, add someone with an excellent driving record under their belt. We’re talking mums, dads and grandparents here. - Max out your excess

Be warned, though; this does come with a catch. In the event of a claim, this is the amount you’ll have to pay out as part of the claim. So only use this one if you’re really keen to push down the cost.

What about young drivers’ third party only insurance?

Previously this was a young driver’s go-to solution to save money. However, it is risky as third party car insurance only protects you from claims another driver may make in the event of an accident. You won’t receive any money for your car if you’re involved in an accident – or if your car gets stolen or damaged.

So, not a fantastic policy if you live in an area where vandalism or car crime is statistically high. That said, insurers now see third party only insurers as a high-risk group. Consequently, premiums can be higher than if you took out fully comprehensive insurance in some cases. The logic being, if you care that little about your vehicle, are you a riskier investment for the insurer?

Frequently Asked Questions By Young Drivers

Can young drivers find car insurance for under £1000?

Yes – it all depends on where you live, the car you drive and more. The quickest way to find out how much you might pay is to get a quote.

What else can I do to get the policy under £1000?

If you are yet to buy a car, consider purchasing one with an immobiliser and try the following tips:

- Parking your car off-street will help keep your insurance down. Understandably this option is not available to everyone, but if you can, then make use of it.

- Keeping your mileage down means you will spend less time on the road and, therefore, less likely to be involved in an accident.

- Opt for telematics to be included in your policy; this helps keep costs down as insurance companies can monitor your driving. This is particularly appealing for young drivers who are statistically more likely to be involved in a crash; show them you are a sensible driver and be rewarded for it.

- Car Type – you are new on the road, and you don’t need the coolest cars just yet as there’s plenty of time for that, not to mention the fact that they cost more money! So why not go for a car in a sensible insurance group. Which insurance group should you choose? Insurance groups range from 1 to 50, and we recommend that new drivers stick to Group 1 and 2 if they aim to get your insurance below a thousand pounds.

Do I need a no claims bonus?

Understandably many drivers under 25 do not have any no claims bonus, which is not a problem as you are in the same boat as many others. To help keep your insurance down, make sure you follow the rest of the advice on this page.

I’m a young driver with points on my license; what can I do?

If you are a relatively new driver and have points, you can expect your insurance to go up a bit; however, if you follow the advice on this page, you may still be able to get your premium down. The most important thing is always to declare your points and convictions on your insurance quote; otherwise, you may invalidate your claim. If you have convictions, you may want to try our convicted driver insurance page.

Can I get car insurance as a young driver if I have had an accident?

You can still get insurance if you have had an accident; however, it will likely be more expensive, mainly if you lost any no claims bonus.

How much is car insurance for teenage drivers?

The cost of insurance varies so much between each driver that it is impossible to say. The only sure-fire way to know how much your insurance will cost is to get a quote by clicking the button at the top of the page.

Can you help find insurance for learner drivers?

Yes, we can! Please visit our learner driver insurance page to find more information and compare quotes.