Who needs motor trade insurance

In short, anyone who works with other peoples’ vehicles in any way. If you own the business or work for yourself, either as a sole trader or through a limited company, you will need to get your own insurance. If you work for a company, however, their insurance should cover you. But definitely check before you start work.

Here’s a short list of people who would need motor trade insurance:

- Car dealers

- Valeters

- Car transportation

- Breakdown and recovery

- Car restoration

- Scrap dealers

- Car parking or car jockey service

- Garages offering repairs, tyre fitting, MOT stations, servicing etc

- Mechanics

- Working with cars when self-employed, working from home and part time – you can buy specific part-time motor trade insurance

Is motor trade insurance a legal requirement?

If you run a business in the motor trade, yes, it is a legal requirement. If you don’t have at least basic cover, you will be breaking the law, and can be fined thousands for every day you don’t have the insurance. Ouch.

What does motor trade insurance cover?

Motor trade insurance, in all its guises, covers the varying risks of working with and driving other peoples’ vehicles. From driving customer cars on the road to insuring the parts you keep in stock, motor trade insurance ensures your business and livelihood are protected in the event something goes wrong.

The great thing with motor trade insurance is also what can make it frustrating. It’s very customisable. You’ll be able to specify exactly what you’d like cover for, based on what your business does. This means you can make the policy as lean or as comprehensive as you like, and only pay for what you need.

Motor trade insurance tends to cover a selection of these:

If you or your employees drive customer vehicles and the business’ vehicles on the road, you’ll need some form of road risk insurance. Like standard car insurance, this is a legal requirement. Road risk insurance is broken down into three sub-levels:

Third party only

The legal minimum requirement, this covers the cost of damage to any other car, property or person in the event you have an accident while driving a customer’s or business’ vehicle. It doesn’t cover the car your driving – you’d have to pay for damage to that yourself.

Third party, fire and theft

This offers the above, plus cover for when a car in your care, custody or control is stolen or damaged by fire.

Comprehensive

Just like with standard car insurance, comprehensive cover includes third party, fire and theft, and it also covers the car you’re driving. This could be a customer’s car or a business vehicle.

This covers the cost of legal fees and compensation if you get sued or taken to court by an employee, customer or member of the public. They’re typically broken down into three sub-categories:

This is a legal requirement if you employ anyone. It covers you in the event that one of your employees becomes injured at work, including legal fees and compensation. If you have any employees and don’t have employer’s liability, you could be fined thousands of pounds for every day you don’t have it.

Product liability

This isn’t a legal requirement, but it covers you in the event a customer takes you to court over a faulty product. For example, if you fix their car with a product then later fails, and they become injured in the process, this would cover the legal fees and compensation that could result from the claim.

Public liability

And finally, public liability also isn’t a legal requirement. It will cover you in the event a member of the public, be they a customer or not, has an accident because of your business. For example, if someone tripped in the forecourt and injured themselves, they could make a case against you.

Combined insurance is simple – it is both road risk and liability wrapped into one policy. Plus, there’s also the option to include cover for your tools, equipment and the workplace itself. It’s also worth noting, if you also drive your work car for personal journeys, in the evenings and on weekends, for example, you’ll also need to add domestic use to your policy.

Other Covers

Insurance for tools, equipment, the workplace & more

What else can motor trade insurance cover?

There is a great selection of additional categories motor trade insurance can also cover. All of these are optional add-ons you can specify when comparing and tailoring your policy.

Material damage

Material damage

This insures any parts and stock you keep in the premises, up to a certain amount.

Business premises cover

Business premises cover

Specific cover for your workplace building or forecourt. If you rent your premises, it’s worth checking with your landlord whether they provide this as standard.

Demonstration cover

Demonstration cover

Do you run demonstration cars, or let customers take your cars out for test drives? This one’s for you.

Specialist vehicle cover

Specialist vehicle cover

Cover for more specialist vehicles, including heavy goods vehicles, vintage cars and exclusive vehicles.

European cover

European cover

If you need to drive stock or customers’ vehicles across the continent.

Goods in transit cover

Goods in transit cover

This insures any goods you may transport as part of your business.

Parts only

Parts only

If you don’t drive your customers’ cars at all, you may find parts only cover is cheaper. Bear in mind, however, you won’t be covered at all, not even to move the vehicle.

How to get cheap motor trade insurance

As a specialist type of insurance that covers a lot of eventualities and items, motor trade insurance can be pricey, especially if you’re new to the business. If this is your first time buying motor trade insurance, check out our guide.

Here are our top tips for keeping the cost of your motor trade insurance down:

1

Only pay for what you need

Motor trade insurance policies can be slimline or they can be huge. If there are certain things you don’t need, take them off. For example, if you don’t drive your customers’ or the business’ cars on the road, don’t go for road risks.

2

Specify the type of vehicles you work on

If you only work with standard vehicles, make sure you’re not ensured for ‘any vehicle’, which will include more expensive, specialist vehicles.

3

Set a vehicle limit

Consider whether a limit on the number of vehicles you want to insure would work for you. Unlimited cars will be more expensive.

4

Consider a higher excess

Like with all insurance premiums, you’ll agree a voluntary excess when you purchase the policy. Increasing this will reduce your premium. But it must be realistically affordable for the business!

5

Who do you employ?

Where you can, employ experienced drivers with clean driving records. Anyone under the age of 25 will be more expensive to include on the insurance. Have a look at our guide for under 25s motor trade insurance.

6

How many drivers do you need?

Only cover the number of drivers you need, rather than ‘any driver’ to bring down the cost.

7

Pay annually

Paying monthly might be less of a sting, but it’s likely to make your premium more expensive. Pay annually if you can.

8

No claims bonus

Just as with standard car insurance, motor trade insurance comes with a no claims bonus. If possible, try to build yours up to reduce your premium year on year. Your personal driving no claims bonus will be taken into account, but you can also ask if there’s an option to move your personal no claims bonus over to this policy. Some insurers will let you transport it.

9

Improve your security

Upgrading your CCTV, gates, locks and burglar alarms will all help to bring the price down.

10

Compare every year

And of course, run a comparison each year to find the best price! Although it’s easy to renew every year with the same provider, most policies will increase with age, so it’s always worth doing a comparison online. Our online tool aims to make it as easy as possible.

What is the Motor Insurance Database (MID)?

The MID is the nationwide record of all insured vehicles in the UK. It’s used by the police and the DVLA to check and enforce motor insurance laws. Any vehicles used for work or personal use must be registered. When you buy your motor trade insurance, the provider will contact you to get the relevant data to update the database. This means that whenever a car comes into or leaves your business, you must let your insurer know as soon as possible, so they can update the database for you.

Motor trade insurance FAQs

Buying motor trade insurance can be a complicated business, especially if you’re new to the trade. We’re here to make things as simple as possible, so here are a few questions that pop up often.

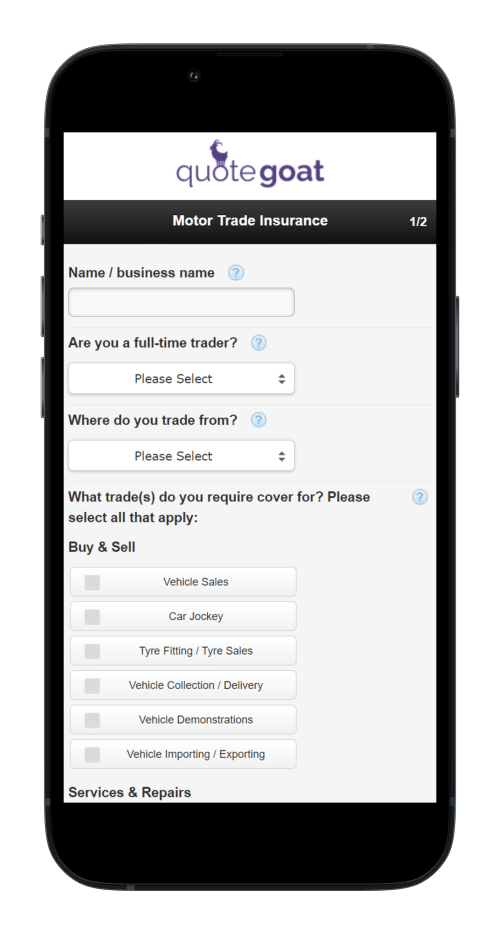

What do I need to purchase motor trade insurance?

In order to purchase motor trade insurance, you just need to prove that you own and run a motor trade business. When you fill out our short form to compare quotes, we’ll ask you questions like how many years you’ve been trading, the trading address, and type of business that help us match you with providers. Once you’ve bought the policy, you may be asked for a document to prove you own the business.

Is my personal car covered by motor trade insurance?

You can decide to put your personal vehicles on the policy, however, bear in mind it will make your premium more expensive. For the best deal, we recommend also running a comparison for standard car insurance to find out which works out cheaper.

Can I protect my trade no claims bonus?

Yes, just like with personal insurance, you can choose to protect your no claims bonus. While this may make your premium more expensive, it could be a good idea if you have young or inexperienced drivers on your policy.

Is there a minimum age to be eligible for motor trade insurance?

Whilst there is no official minimum age, aside from the fact that you will need to be old enough to drive, a lot of insurance providers will have a minimum age of 21 or even 25. If you need motor trade insurance for people under 25, we can help, by arranging quotes from up to 5 insurance specialists which increases your chances of finding a policy that is suitable for young people.

I run my business from my home, do I need motor trade insurance?

If you run your motor trade business from home you will still be required by law to have motor trade insurance. In terms of the level of insurance required, you may find that road risk insurance offers enough cover as opposed to combined cover which would protect the “on the road (road risk)” part of your work as well as other areas which may include your contents, equipment and stock.

I’m unsure as to the type of motor insurance I need, who can I ask?

When you submit the motor trade insurance quote form, you will be contacted by up to five insurance providers. These providers are specialists and can offer no obligation advice and assistance as well as providing you with tailored policy quotations. Particularly useful for people who are new to the industry, expert advice can help you organise motor trade insurance for the first time.

How can I reduce the cost of my motor trade cover?

Our top tip is to run a comparison each year, prior to letting your policy auto-renew with your current insurance provider. Whereas long-standing customers often reap rewards for their loyalty, this is not always the case when it comes to insurance – running a comparison each year takes a matter of minutes and you may be pleasantly surprised with the outcome.

Does a motor trade policy cover driving any car?

It is a common misconception that the holder of a motor trade insurance policy will automatically be covered to drive any vehicle. This is usually not the case. A motor trade policy will normally only cover you to drive your own vehicles or customers’ vehicles, for motor trade purposes. This means that you are most likely not covered for driving a family member’s car and perhaps less obviously, you will not be covered in the event that you simply fancy taking a customer’s car for a spin, it needs to be necessary or related to the work you are doing on that customer’s vehicle. If in doubt, check with your policy provider.

I work part-time, can I have part-time motor trade insurance?

If you have another job or you are retired whilst also running a part-time motor trade business, it is possible to arrange part-time motor trade insurance which will make allowance for the fact that you operate under reduced hours. This reduction in hours may help reduce the cost of your policy.

Which motor trades require insurance?

Motor trade insurance is applicable to nearly every trade in the industry. If you are likely to be driving a customer’s car as part of your work then you will need some form of cover. This includes: mechanics, car valeters, MOT garages, tyre fitters and vehicle sales, all of which will normally require you to drive a car owned by your customer or by the business.