Taxi Insurance

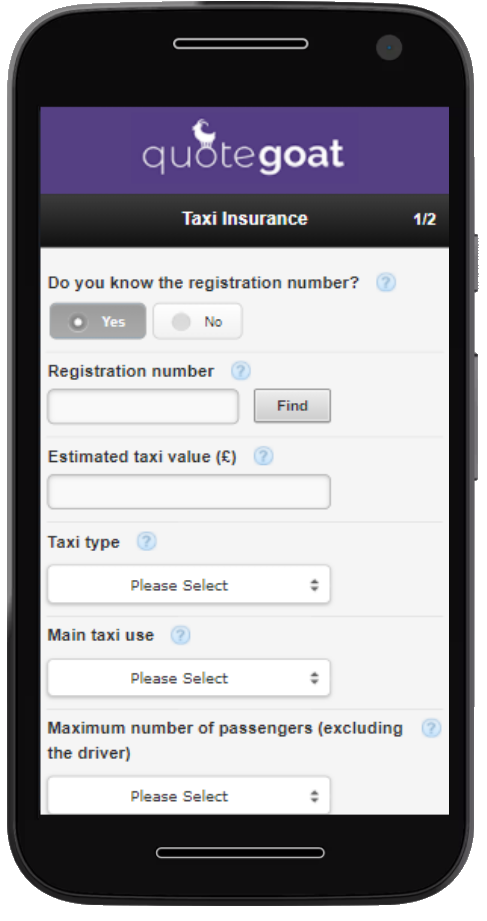

Compare taxi insurance policies from up to 5 insurance providers with one short quote form.

Get A Quote

One short quote form

Suitable for all taxi types

Save time and money - rated 4.8/5

Compare taxi insurance policies from up to 5 insurance providers with one short quote form.

One short quote form

One short quote form Suitable for all taxi types

Suitable for all taxi types Save time and money - rated 4.8/5

Save time and money - rated 4.8/5

Quote Goat are specialists in insurance. We place excellent customer service at the heart of our company and as such we commit to:

Rating providers only by what is best for customers

Rating providers only by what is best for customers

Going above and beyond to help all users who need assistance

Going above and beyond to help all users who need assistance

Never selling or misusing our customers’ data

Never selling or misusing our customers’ data

Aiming to partner with the best comparison tools on the market

Aiming to partner with the best comparison tools on the market

Always being 100% impartial

Always being 100% impartial

We are 100% privately owned and we are committed to always promoting the provider that is best for our customer.

We are rated 4.8 out of 5 on Reviews.io and we help over 50,000 businesses a year to find the right cover

Our goal is to simplify money management, everything we do is guided by our ethos of putting our customer first.

Easy to use and quick to get my quote for insurance, saved £200 from last year as well! Would recommend.

Easy to use site, made a significant saving in comparison to other places I checked. Would highly recommend using QuoteGoat…. Will 100% use the site again!

Excellent experience. Really easy to use and would definitely recommend. My go-to comparison site from now on!

Taxi insurance is a specialised type of insurance designed to cover vehicles used for transporting passengers for hire. This coverage goes beyond standard motor insurance, taking into account the unique risks associated with operating a taxi or private hire vehicle. Taxi insurance typically includes provisions for bodily injury, property damage, and medical expenses for both passengers and third parties. Additionally, it may cover the taxi driver's liability, vehicle damage, and theft. Due to the nature of the service and the increased exposure to potential accidents, taxi insurance is a crucial safeguard for both drivers and passengers.

Taxi insurance costs can vary significantly between insurance providers so it pays to shop around. Whether you need Black Cab insurance, Minicab insurance, Uber insurance or cover for another vehicle that transports passengers, you will need to have the right cover in place to protect yourself and your business.

Finding taxi insurance is easy with Quote Goat. Take just a moment to fill out the quote form and see how much you could save.

Typically the cheapest level of cover, with the cost increasing for each name that you add to the policy.

Insurance for a taxi driver purchasing their own policy covering just themselves.

As the name suggests, dependent on the policy, it can cover any driver using your taxi but can often come with restrictions.

The minimum level of insurance required by law, covers you for damage or injury to 3rd party property and 3rd parties if you are deemed to be at fault. Third party will not cover damage to your own taxi or yourself.

Covers the above as well as the cost of replacing or repairing your taxi should it be stolen, damaged during an attempted theft or as a result of fire damage. It is important to note however that your claim may not be paid out unless you adhere to your policy’s terms which for example could include not paying out for theft if your vehicle was not properly secured.

The most complete level of cover which will usually everything above as well as damage to yourself or your taxi in the event of a claim, if it is your fault. Fully comprehensive policies may also include optional extras such as legal protection, which you can decide whether you require or not.

In general, taxi insurance prices are calculated based on levels of risk. As a taxi driver, you will be on the road for longer than your average driver, you will often be working on congested roads as well as driving during unsociable hours and your vehicle could be larger than a standard vehicle which will place it up a higher insurance group.

These factors can contribute to increasing the cost of taxi insurance policies. However, there are several ways that you can find cheaper taxi insurance.Compare quotes: Quote Goat make this easy by giving you access to a leading panel of taxi insurance specialists.

Do not auto-renew:Compare taxi insurance quotes each year to see if you can make a saving or to ensure that you are not over-paying for your cover when you renew your current policy.

Lower insurance group: As mentioned above, the insurance group that your taxi belongs to can significantly impact insurance costs. When buying a taxi, please pay attention to the insurance group.

Avoid convictions: All types of convictions can push up insurance costs, both non-motoring and motoring, so it pays not to speed, use your mobile or commit any offence that you must declare to your insurance provider.

No claims discount: Building up a no-claims bonus can significantly reduce the cost of insuring a taxi.

Legal cover, breakdown cover and public liability insurance are all optional extras that you may wish to include with your policy. We have listed a few other extras below to help you decide if you require any of them.

If you are unsure about whether you require any extras, the insurance provider you speak to will be able to advise.

Please note that including these covers in your policy may make it more expensive, but it could also save you money should the unexpected happen.

Damage to windscreen

Damage to windscreen

Can often be incorporated into your policy, however it is also known to come as an optional extra.

License loss

License loss

It is possible to get protection in case you lose your license, paying you an income for a period once the license is taken away.

Home assistance

Home assistance

Assistance if you break down or your taxi will not start at your home.

Ongoing transfer cover

Ongoing transfer cover

Assistance for passengers who need to carry on with their journey if your taxi breaks down.

Public liability

Public liability

Protecting you against claims made by members of the public for injury or damage.

Breakdown cover

Breakdown cover

Insurance to cover the costs of a breakdown.

Non-taxi use

Non-taxi use

Coverage for your own use of the taxi out of working hours can also be provided by some providers and is subject to your licensing authority’s rules.

Legal assistance

Legal assistance

Cover against legal fees and losses incurred as a result of an accident that was not your fault.

1

Make and model of your taxi or registration plate, type of taxi, type of use and approximate vehicle value.

2

Level of cover, no-claims bonus details for your taxi and a private no-claims bonus if applicable. How long you’ve held your taxi badge, who will be driving and details of any claims or motoring convicting in the last 5 years.

3

Your name, address, date of birth & contact details.