What is a black box or telematics taxi insurance policy?

A “black box” or a “telematics box”, as they are also known, is a small box that is installed within a vehicle, usually out of sight behind the dashboard and is responsible for recording driving information. They record telemetry as well as cornering, braking and accelerating habits as well as the speed at which you drive.

The box also contains a GPS that records the exact location a car has been driven and at what times. The black box has no control over the car, it is simply there to record how the car is being driven and to be able to record the location of car should the vehicle be stolen or involved in an accident.

Why have a black box policy for your taxi?

These are the main reasons that any taxi driver, particularly beginner cabbies could want to have a black box installed in their car:

Vehicle Tracking

Not only is it important for the taxi company to know where all of their vehicles are in order to organise collections in an economical manner, if the vehicle is stolen the GPS tracking can help police quickly locate and retrieve the stolen vehicle.

Journey Optimisation

By being able to track where each taxi is, taxi companies are able to optimise routes to reduce fuel consumption, reduce unnecessary mileage and better manage taxi driver’s working hours. Overall this will benefit revenues and reduce unnecessary costs.

Improve customer service

People in search for a taxi appreciate a fast and efficient service; nobody wants to be waiting around for long periods of time for a lift. With GPS tracking through a telematics box, taxis are less likely to break down and can travel more efficiently when directed via the optimum routes.

Insurance Purposes

With a black box equipped, insurance companies know for a fact that they aren’t going to be on the receiving end of false claims and can easily identify drivers who don’t speed or drive in a dangerous manner.

Telematics boxes record all driving habits so insurers will know if you were speeding or driving in an erratic fashion at the time of an injury. With a black box equipped in your taxi you can also receive the benefits of reduced insurance rates. Compare taxi insurance quotes online with Quote Goat to see if a black box could help reduce your policy.

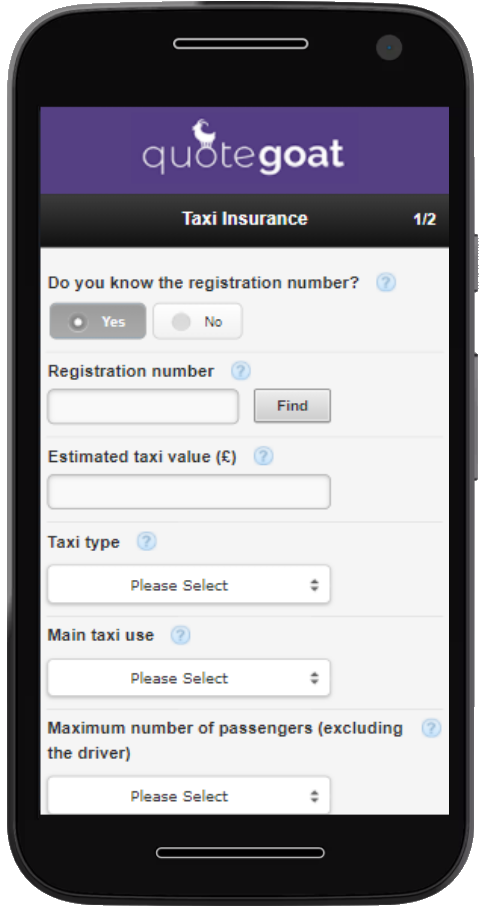

What information is required to get an insurance quote?

Getting a quote is quick, free & easy. The information you will need to hand includes:

1

Taxi Details

Make and model of your taxi or registration plate, type of taxi, type of use and approximate vehicle value.

2

Cover Details

Level of cover, no-claims bonus details for your taxi and a private no-claims bonus if applicable. How long you’ve held your taxi badge, who will be driving and details of any claims or motoring convicting in the last 5 years.

3

Your Details

Your name, address, date of birth & contact details.

Types of black box taxi insurance policy

There are three main types of taxi driver insurance to choose from when it comes to a private hire taxi: policy-only, named driver and any driver.

As well as these three types of taxi insurance, you will also need to choose whether you have third party only, third party, fire & theft or fully comprehensive cover; just as you would for a standard motor insurance policy.

Policy-Only

Typically the cheapest level of cover, with the cost increasing for each name that you add to the policy.

Named Driver

Insurance for a taxi driver purchasing their own policy covering just themselves.

Any Driver

As the name suggests will cover any driver using your taxi.

Third Party Only

The minimum level of insurance required by law, covers you for damage or injury to 3rd party property and 3rd parties if you are deemed to be at fault. Third party will not cover damage to your own taxi or yourself.

Third Party, Fire & Theft

Covers the above as well as the cost of replacing or repairing your taxi should it be stolen, damaged during an attempted theft or as a result of fire damage. It is important to note however that your claim may not be paid out unless you adhere to your policy’s terms which for example could include not paying out for theft if your vehicle was not properly secured.

Fully Comprehensive

The most complete level of cover which will usually everything above as well as damage to yourself or your taxi in the event of a claim, if it is your fault. Fully comprehensive policies may also include optional extras such as legal protection, which you can decide whether you require or not.

Black box taxi insurance extras

Legal cover, breakdown cover and public liability insurance are all optional extras that you may wish to include with your policy. We have listed a few other extras below to help you decide if you require any of them.

If you are unsure about whether you require any extras, the insurance provider you speak to will be able to advise.

Please note that including these covers in your taxi insurance policy may add to the cost of your policy, but it can also save you money should the unexpected happen.

Damage to windscreen

Damage to windscreen

Can often be incorporated into a taxi insurance policy, however it is also known to come as an optional extra.

License loss

License loss

It is possible to get protection in case you lose your license, paying you an income for a period once the license is taken away.

Home assistance

Home assistance

Assistance if you break down or your taxi will not start at your home.

Ongoing transfer cover

Ongoing transfer cover

Assistance for passengers who need to carry on with their journey if your taxi breaks down.

Public liability

Public liability

Protecting you against claims made by members of the public for injury or damage.

Breakdown cover

Breakdown cover

Insurance to cover the costs of a breakdown.

Non-taxi use

Non-taxi use

Coverage for your own use of the taxi out of working hours can also be provided by some providers and is subject to your licensing authority’s rules.

Legal assistance

Legal assistance

Cover against legal fees and losses incurred as a result of an accident that was not your fault.