Types of care home insurance explained

As a specialist business insurance, there are lots of customisable elements to a care home policy. The standard cover levels include buildings and contents, as with most other insurance policies. After those, you can tailor and customise to your business’ specifications.

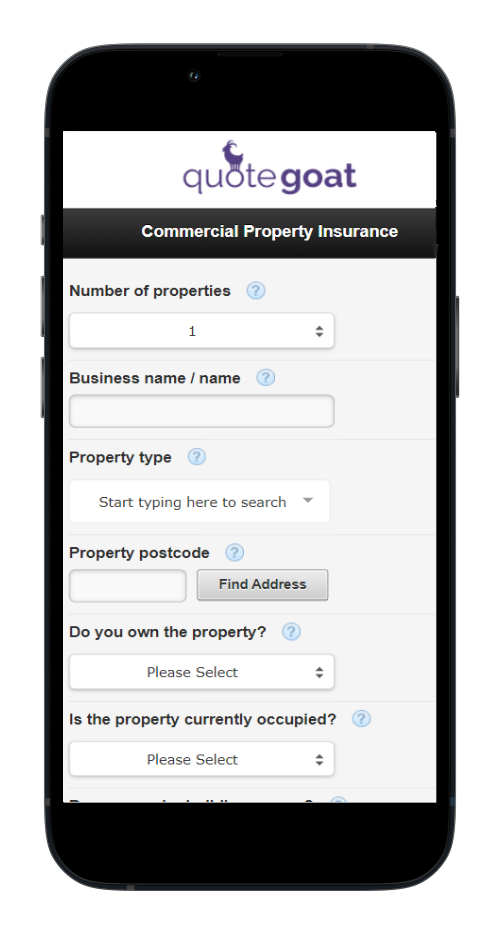

Commercial property insurance

Care home insurance falls under commercial property insurance, as you run a business from the property. Within this, the insurance is broken down into buildings and contents cover.

- Buildings cover

This protects the building(s) associated with the business from damage, such as fire, flooding and subsidence. It covers the bricks and mortar of the building itself, including walls, floors, fixed or plumbed-in goods, car parks and sometimes maintained gardens.

- Contents cover

As with domestic home insurance, contents cover protects the items within the buildings. This includes things like furniture, kitchen crockery and cookware, clothing, electronics and books. It can even cover food in fridges and freezers. The best way to think about contents insurance is to imagine what would fall out if you were to turn the buildings upside down. Contents insurance for care homes can also include cover for residents’ belongings.

Employer’s liability insurance

Under the Employers Liability (Compulsory Insurance) Act, it’s a legal requirement for any business who employs at least one person to have employer’s liability insurance. This protects your staff in the event of something unexpected happening.

Public liability insurance

As your business has members of the public under its care, as well as friends and family members coming to visit, public liability insurance is very important. This protects you in the event of an accident or injury to a member of the public or their property. From a stone flicking up and breaking a visitor’s car window to someone falling over and injuring themselves, public liability has it covered.

Care home insurance can also include more specialist cover within public liability insurance, such as treatment liability and abuse cover, which protects the business if allegations of sexual, mental and physical abuse on residents are made.

Stock cover

If any stock is stored on the premises, such as medications, bedding and blankets and uniforms, stock cover can protect these items against damage and theft.

Business interruption insurance

If something goes wrong and the business’ income goes down – for example, if a resident’s room floods and they move elsewhere while the room is repaired – you can ensure the income continues as normal with business interruption insurance. This allows you to continue paying your staff and running the business smoothly.

Cyber liability

As care homes tend to store personal data on their patients, staff and suppliers, cyber liability insurance is there to cover the risk of malware attacks and cyber crime. As well as financial protection, cyber liability insurance often also includes a Public Relations team, who can help you manage the situation in the event of an attack or data leak.

How much does care home insurance cost?

As with all insurance premiums, the cost will vary depending on the business and the level of cover it needs. Here are a few things that can determine how much your quotes will be:

Nature of the business

Nature of the business

Different types of care providers come with different risk profiles.

Number of employees

Number of employees

Higher numbers of employees can present higher risks for insurance providers

The level of cover

The level of cover

Make sure you specify exactly what the care home needs, so you don’t end up paying for unnecessary items.

Voluntary excess

Voluntary excess

If the quote is really expensive, try increasing your voluntary excess. Make sure to keep it realistic though, as you will need to be able to afford it in the event of a claim.

Property location, size and age

Property location, size and age

Your property’s characteristics will determine how much risk it represents

Security

Security

Make sure to check all CCTV cameras, burglar alarms and locks are up to date and working.

Claims history

Claims history

Policy holders that have not claimed on their insurance previously may be deemed to be less of a risk.

How you pay

How you pay

Just like with any insurance, often if you can stump up and pay annually, rather than monthly, it’ll be cheaper.

Care home insurance FAQs

Is care home insurance a legal requirement?

While care home insurance specifically isn’t a legal requirement, anyone who has employees must legally have employers’ liability insurance. Every care home employer in the UK is legally required to have cover for compensation of at least £5 million. Every day that you don’t have the above will result in hefty fines.

Can I buy care home insurance for multiple properties?

Yes, you can. Your two main options are to insure each property individually, which is less complex but may be slightly more expensive. Or you can buy one policy, covering multiple care homes.

Can you pay for care home insurance monthly?

Absolutely. Nearly all insurance policies today allow you to choose to pay monthly or annually. While paying monthly is easier, if you can afford to, paying annually tends to make policies slightly cheaper.